Hit enter to search or ESC to closes

Triple-A

Enhancing at an Early Stage the Investment Value Chain of Energy Efficiency Projects

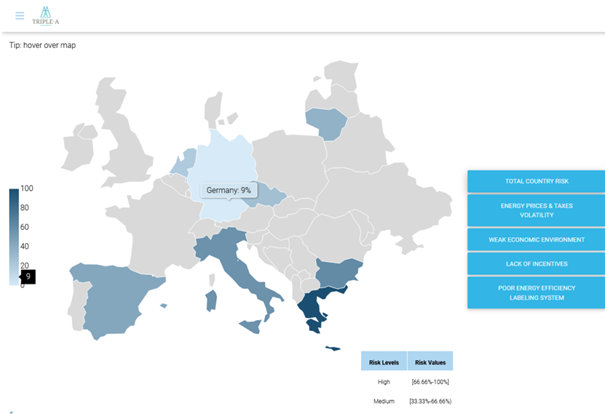

The project “Triple-A: Enhancing at an Early Stage the Investment Value Chain of Energy Efficiency Projects” is a European Initiative funded by the EU Horizon 2020 programme, which assists financial institutions and project developers in increasing their deployment of capital in energy efficiency, making investments more transparent, predictable and attractive already from the first stages of investment conceptualisation.

The project was initiated in September 2019 and ended in May 2022, achieving remarkable results in promoting real energy efficiency projects to investors. Triple-A was a joined effort of a consortium of academic and research institutions, market actors, project developers, financial institutions and industry partners from Bulgaria, the Czech Republic, Germany, Greece, Italy, Lithuania, Spain and The Netherlands.

The most important breakthrough of the project is the Triple-A Toolbox, which consists of the Triple-A Tools (Assess – Agree – Assign) and the Web-based Database on Energy Efficiency Financing, the state-of-the-art platforms in energy efficiency financing, analysing and benchmarking projects, and linking them with advanced financing models and potential investors.

Find the analytical reports with the Triple-A methodologies and results here.

Credit photo: michael-longmire-lhltMGdohc8-unsplash